Milking It, Dairy Field Magazine, April 2001

Melody Farms capitalizes on its long-term reputation for delivering superior customer service. Of course, everyone knows it’s good business practice to listen to your customers, to adapt and improve all the time. But now more than ever the competitive dairy industry demands that processors place customer relations at the pinnacle of their priority lists.

Melody Farms capitalizes on its long-term reputation for delivering superior customer service. Of course, everyone knows it’s good business practice to listen to your customers, to adapt and improve all the time. But now more than ever the competitive dairy industry demands that processors place customer relations at the pinnacle of their priority lists.

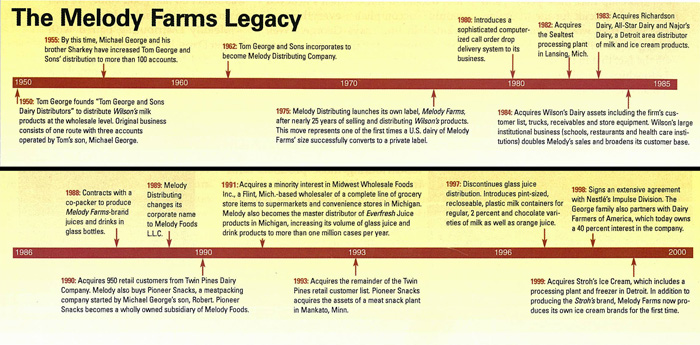

Old news, says Livonia, Mich.– based Melody Farms. Founded in the 1950s with $412, a coffee table and an 11-year-old milk truck, this family-run firm has long recognized that the ability to tune into and understand a customer’s needs places it well on the path to enhancing long-term customer relations, increasing sales, expanding market base and developing new marketing directions.

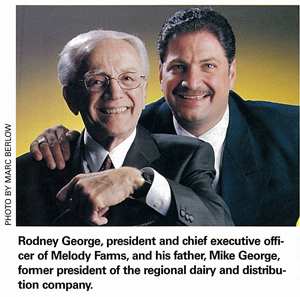

“I decided to go into the milk business in 1950. I would drive up and down the streets in my dad’s old truck, just trying to get business and not knowing anything about it,” recalls Mike George, son of company founder Tom George and past president of Melody Farms. “I was 17 years old, had no relationship with these people, and it was very difficult for me to understand why they wouldn’t buy. It had nothing to do with price. It had to do with the fact that in the dairy industry, relationships develop between the supplier and the customer that are very hard to break. The supplier-customer bond was an important issue then and continues to be one to this day.”

In the beginning, the George family business was known as Tom George and Sons Dairy Distributors, with a clientele consisting of just one route with three accounts. The company grew nonetheless, largely due to the perseverance of Mike George and his brother, Sharkey; the firm subsequently distributed product for Michigan-based Wilson’s Dairy for nearly 25 years.

“When I started in the business, I had a dream that we would do a million dollars in sales, which I believed would accomplish everything I wanted in life,” says George. “Well that million dollars came rather quickly. Then I set a new goal of five million dollars, and it took a few years, but that came rather quickly also. Next, I thought to myself, $10 million dollars is my dream. That $10 million took 25 years.”

In the wake of attaining $10 million in sales, the George family made a pivotal decision regarding the future of Melody Distributing (Tom George and Sons incorporated in 1962 to become Melody Distributing Company). Despite dissuasion from its long-term partner, Wilson’s Dairy, the risk-taking company in 1975 developed its own branded label. “As a distributor, we were never really building equity in our company,” notes George. “In order for us to do something that was solid and had good value, we had to produce our own label.”

Melody Distributing paired with Kroger Dairy, later known as Michigan Dairy, and began distributing Melody Farms milk and ice cream. Millions of dollars worth of television and radio advertising followed, boosting the company’s brand presence and increasing its sales from $10 million to $30 million in the next five years.

Numerous acquisitions – including the ultimate buyout of Wilson’s Dairy – and business maneuvers later, Melody Farms continues to aspire to bigger and better things. With sales in excess of $130 million, the company today owns and operates two processing plants in Lansing and Detroit, Mich., and remains one of the largest privately-owned dairy and beverage distribution companies in the Midwestern United States.

Numerous acquisitions – including the ultimate buyout of Wilson’s Dairy – and business maneuvers later, Melody Farms continues to aspire to bigger and better things. With sales in excess of $130 million, the company today owns and operates two processing plants in Lansing and Detroit, Mich., and remains one of the largest privately-owned dairy and beverage distribution companies in the Midwestern United States.

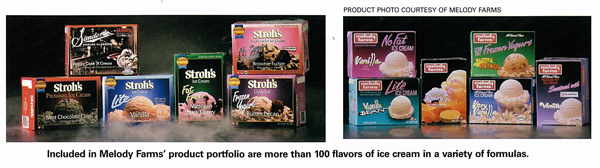

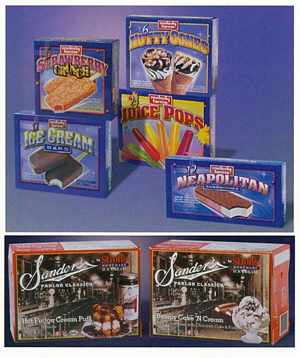

Melody Farms brand products include an assortment of fluid milk, cultured dairy products and yogurt, more than 100 flavors of ice cream in a variety of formulas, including premium, no-fat, lite, no sugar added and sherbet, and a full line of juice products. The company’s ice cream brands include Melody Farms, Stroh’s, Nafziger’s and Mooney’s, while its fluid milk products fall under the Sealtest and Melody Farms brands.

So what does Mike George aspire to these days? “Over the years, I’ve learned that in order to stay in business you can’t have specific goals,” he says. “You must continue to grow or die. It’s part of the nature of the business. For example, when I started in the business in 1950, there were more than 150 dairies in the state of Michigan. Today there are less than 10.”

Buying & Selling

Buying & Selling

The rapid rate consolidation in the dairy industry has indeed given Melody Farms cause to evaluate its future. But according to the next generation of Georges, the future holds promise for this progressive regional dairy.

“There is no reason why we couldn’t be a Suiza or a Dean Foods,” stresses Rodney George, Mike George’s son and today’s president and chief executive officer of Melody Farms. “There are plenty more dairies out there, and state by state we will continue to grow. By the time I’m 50 years old, I would like Melody Farms to be a half billion-dollar company. And then a billion-dollar company. It’s the only way we are going to survive.”

Thirty-seven-year-old Rodney George, one of four Georges currently guiding Melody Farms on its journey, points to mega dairies’ ability to launch national retail programs as well as consolidation amongst retailers as subjects of concern.

The secret to longevity for a regional player, he insists, is a commitment to quality products and above all else, superior customer service. “I know we’re a strong enough company and have a strong enough team to succeed,” he says. “Our service level and our customer base seems to be moving along with us without a problem, so I believe we can overcome all the issues related to consolidation. Service and our relationship with our customers are most important. Melody Farms is successful because our priority is making sure our customers are successful.” Melody Farms’ relationship with Dairy Farmers of America (DFA) also plays an important role in ensuring its continued success. DFA has owned a 40 percent interest in Melody Farms for several years, providing the company with its raw milk supply as well as a shield from potential suitors.

Rodney George refers to DFA as “silent partners,” noting that the George family has complete autonomy to manage Melody Farms however it sees fit.

“It’s a wonderful relationship. They [DFA] are a great milk supplier, and they are great partners to help us grow,” he says. “They’re not corporate people either. They just want to make sure they get a return on their investment. Together, we are a good, solid team.”

Consolidation, particularly in the retail industry, has, however, prompted Melody Farms to re-evaluate its customer base over the years. Once limited to mostly independent retailers and convenience stores, the company has been forced to vie for national retail chains – with success. Today the lion’s share of Melody Farms’ business belongs to national retail accounts, convenience stores and drug store chains.

About 15 percent of the firm’s business is comprised of institutional accounts such as hotels, hospitals, dietary services and schools. This segment of its business has shifted as well, as institutional accounts increasingly seek out the convenience offered by institutional wholesalers.

About 15 percent of the firm’s business is comprised of institutional accounts such as hotels, hospitals, dietary services and schools. This segment of its business has shifted as well, as institutional accounts increasingly seek out the convenience offered by institutional wholesalers.

“The retail independent stores used be the nucleus of our business. That was our foundation, and today the independent store is almost extinct with the exception of specialty stores or high-end stores,” observes Mike George. “We had no choice but to go out and get the Wal-Marts of the world. We saw that our independent businesses were deteriorating, so we had to go after larger customers.”

The dairy industry’s buying and selling frenzy has also benefited Melody Farms’ growth. Among acquisitions throughout its 50-plus– year history, the company in 1999 purchased Stroh’s Ice Cream Co. and consolidated all of its ice cream operations at its Detroit-based processing plant.

The multi-million-dollar deal allowed Melody Farms to produce all of its own ice cream brands and all Stroh’s brands, including Stroh’s, Mooney’s and Nafziger’s, at one facility. Moreover, the move effectively gave Melody Farms total control of its ice cream business, which was previously dependent upon co-packers.

Other co-packing opportunities have, nonetheless, helped Melody Farms increase its efficiency – low– volume product lines are processed elsewhere. The company manufactures all of its half gallons and gallons of ice cream, as well as half gallons, quarts, half-pints and pints of milk in– house. Since it does not have the capacity to produce all of the gallons and half gallons that makeup about 80 percent of its milk business, these items are co-packed. There are, in fact, 13 plants processing such Melody Farms– brand products as aerosol whip, yogurt, butter, cottage cheese and frozen novelties.

In combination with its co-packing strategy, Melody Farms is focused on expansion throughout Michigan, its stronghold state, and is exploring new opportunities in Ohio and Illinois. “We’re going to stick around the Great Lakes region for now,” Rodney George adds.

In combination with its co-packing strategy, Melody Farms is focused on expansion throughout Michigan, its stronghold state, and is exploring new opportunities in Ohio and Illinois. “We’re going to stick around the Great Lakes region for now,” Rodney George adds.

Lateral growth defines the company’s expansion plans. “We will not under any circumstances jump from Michigan to another state without growing on a lateral basis because the inefficiencies of doing something else are very dramatic. We need to have business that we can integrate or help expand with our existing distribution system,” insists Mike George. “For example, where we’re positioned, we have Toledo right on our border. We’re not going to jump to Cincinnati or Columbus because it’s too far away. The logical way for an existing dairy to grow is to grow laterally.”

As a result, Melody Farms’ growth plan calls for manufacturing products at its existing facilities and redistributing those products from its many distribution branches. Acquisition opportunities will follow as Melody Farms saturates these areas.

As a result, Melody Farms’ growth plan calls for manufacturing products at its existing facilities and redistributing those products from its many distribution branches. Acquisition opportunities will follow as Melody Farms saturates these areas.

“We still want to go out and buy companies because that’s the fastest way to grow, but we are only going to buy companies that have synergies with our own company [such as Stroh’s],” adds Rodney George, insisting, however, that Melody Farms’ greatest growth potential lies with the success of its customers. “As our customers open locations, we move with them. We start expanding into states with them. And we play a big part in helping our customers grow – giving them advice, acting as consultants … Graciousness, responsiveness. For our customer base we are an integral part of the community. We are there for whatever they need, and we don’t have any arrogance about us. We are just here to do what we need to do, and I think the customer respects that.”

Mike George agrees, noting that Melody Farms’ long history of helping its retail customers survey the market and act accordingly has helped establish firm customer– supplier relationships.

“We would actually become consultants to our customers – analyzing the market, reviewing the demographics, referring them to get bank loans. Anything our retail customers needed, we were able to supply and help them be successful,” he explains. “What did this do? Well, first of all it developed a relationship, then loyalty, and it also ensured that we had a customer we could retain for a long period of time. That was our marketing strategy for many years. To this day I tell our people: be responsive. We’ll never deviate from that.”

“We would actually become consultants to our customers – analyzing the market, reviewing the demographics, referring them to get bank loans. Anything our retail customers needed, we were able to supply and help them be successful,” he explains. “What did this do? Well, first of all it developed a relationship, then loyalty, and it also ensured that we had a customer we could retain for a long period of time. That was our marketing strategy for many years. To this day I tell our people: be responsive. We’ll never deviate from that.”

Consumer Connection

To strengthen the processor-consumer relationship, Melody Farms largely relies on market ads in conjunction with its retail partners. Advertising in the most traditional sense – TV, radio, billboards – is becoming more and more scarce, notes Rodney George, in part due to the influx of private labels and the trend toward national retailers promoting their own brands.

In response, Melody Farms has embraced grassroots advertising opportunities in its distribution area.

“We have a relationship with our retailers that supercedes that of ours with the consumer. Our dairy is too small to go directly to the consumer. That’s very expensive. If the consumer comes into a store, he comes to that store because of the store, not because of the products,” explains Rodney George. “The industry is turning more toward business partners with our stores, and whatever we can do to jointly bring customers into these stores, we will do.

“We find this especially true with milk. A lot of our money goes to the trade because we find that wherever people are, they will buy that milk. They are not going to make a special trip just to buy a gallon of milk. So our marketing strategy is to bring them into the stores that we service, regardless of what brand it is, as long as we are producing that milk. Once they are in the store, they will buy our product.”

As a result, Melody Farms participates in everything from market ads and retailer giveaways to carnivals in supermarket parking lots. The firm also advertises via signage at Detroit’s four sports arenas to convey the healthfulness of milk and uses its fully painted distribution trucks as traveling billboards.

Ice cream advertising and promotions require a different strategy altogether, as consumers buy ice cream based on brand loyalty. Melody Farms’ four ice cream brands each retain a loyal customer base in their respective regions of the country – Melody Farms, statewide in Michigan; Stroh’s, mostly Detroit; Napziger’s, Ohio; and Mooney’s, northern Michigan.

“Our goals are to continue to take advantage of that customer recognition,” says Rodney George. “Because we have a branded product and we have a consumer base that is looking for those particular brands, there is no reason to get rid of any of them at this point. Our goals are to continue to take advantage of their brand recognition.”

Product Portfolio

Melody Farms is focused on providing dairy products designed for families, not the individual consumer. One of its largest growth area lies in the flavored milk category.

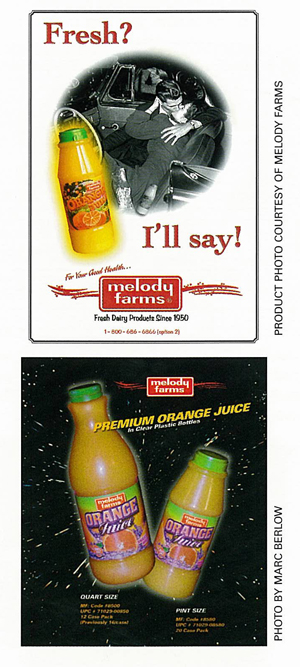

To capitalize on this trend and the benefits of plastic, the company in 1997 started producing pints of chocolate milk, whole milk, low-fat milk and orange juice in PET bottles. Skim milk will soon be added to the lineup in addition to PET quarts, beginning with orange juice.

Seventy percent of Melody Farms’ milk is already in plastics, and the company plans to eventually phase out paperboard cartons altogether. Rodney George estimates that Melody Farms’ milk packaging will be 100 percent plastic within the next two years.

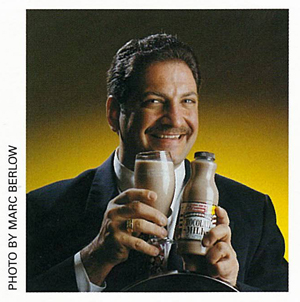

It’s no wonder. The introduction of PET bottles has increased Melody Farms’ pint milk sales by 600 percent. “This just went absolutely wild, and I think it’s mostly because most people are mobile,” says Rodney George. “You cannot take a quart carton of milk in the car. It’s impossible. And this is such a simple concept. You’re putting milk in a bottle that has been around for 100 years – but the dairy industry has been so complacent.

“The packaging side is where the dairy industry can really become the winner, and that’s what we’re going after,” he continues. “We’re trying to figure out what the consumer is really looking for and come up with a package that is transportable, consumer-friendly, works for children and adults – a little bit of everything, especially on the milk side. We’re trying to take the dairy industry out of its standardization. The whole industry is using standard everything, and it is highly regulated. How do you take those standards and change them so you are a little bit different or a lot different from your competitor? Those are the areas we are going to start concentrating on.”

The shape of Melody Farms’ PET pints is undergoing a redesign, for example, to capture a more sleek, easy– to-handle form. In addition, the recloseable snap-off cap eventually will be replaced with a twist-off version.

Rodney George is tight-lipped regarding new concepts for his company’s milk line, offering only that, “We are going to start coming up with products that target specific demographics. I don’t want to give away too many secrets, but we are going to go after drinks that our consumers will drink, and the Michigan consumer is a little different than the rest of the country. They are into specific flavors.

“We are going to go after the beverages pretty heavy. But we have to go beyond the concept of just taking milk and putting flavor in it, to going after a total marketing concept. And we’ll go after the kids. We might as well not market to anyone who is over 18 years old. It just doesn’t work.”

On the ice cream side, while premium and super-premium varieties are increasing in sales industry-wide, the low-fat, non-fat and frozen yogurt markets continue to steadily erode. Many attribute the divergent consumption trends to fickle Americans who say they want nutritional foods, but tend to indulge when they sit down with a scoop or two of ice cream.

Among Melody Farms’ offerings in the ice cream category are nearly 100 varieties of bulk ice cream, 40 varieties of Stroh’s and some 30 varieties of Melody Farms ice cream.

“Ice cream is a different story, and it’s definitely the most popular thing we have going. We advertise ice cream. Everybody has a different flavor or a different formula for ice cream,” notes Steve George, director of product development and Sharkey George’s son. “Most of our advertising with our customers is in-store promotions because we need to stay competitive with different ice creams in the market. We find that if we promote within the stores we see an immediate return on our investment for advertising.”

Sanders, a Detroit-based confectionery famous for its chocolates and dessert toppings, has been instrumental in helping Melody Farms increase its ice cream lineup. The company has paired its Stroh’s brand ice cream with the Sanders brand of inclusions to create such recent new products as French Silk Brownie, Cherry Cordial and Mint Smoothie.

In addition, Melody Farms’ novelty line nearly doubled last year, increasing to 21 varieties, to keep up with the burgeoning novelty market. “We were trying to keep up with our competitors,” explains Steve George, adding that the Stroh’s brand offers an opportunity to someday develop high-end novelties. “To get our products into the stores we needed to offer more varieties. Eleven items don’t cover the gamut anymore. We have to satisfy the consumer and the customer on as many levels as possible.”

That said, Melody Farms will continue to do all it can to provide its customers with superior service and a diverse line of quality products.

“In the future, I believe service will continue to be the most important thing,” predicts Rodney George. “And quality is a given. I think you’re dead without it. It’s about getting down to that customer and that consumer and making sure they feel they are getting the level of service they are looking for. My relationship is with my customer and that customer’s relationship is with the consumer – that’s where all the growth is.”

Copyright Stagnito Publishing Apr 2001

Provided by ProQuest Information and Learning Company. All rights Reserved